In the volatile world of startups, the role of a Chief Financial Officer (CFO) is more critical than ever. A CFO’s strategic insight can mean the difference between a startup’s meteoric rise or its swift fall. This role goes beyond mere number-crunching; it involves strategic planning, risk management, and fostering a culture of resilience and realism. This article explores the key lessons from a renowned CFO, focusing on the importance of embracing a fast-fail mentality and the strategic role a CFO plays in a startup’s success.

I. Embracing a Fast-Fail Mentality

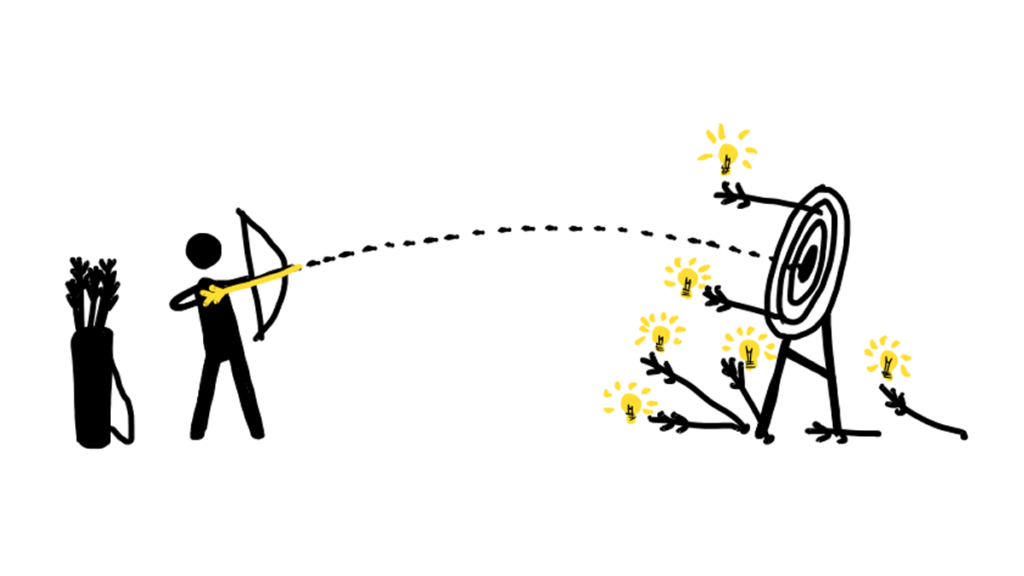

The concept of “failing fast” is integral to the startup ethos. This approach emphasizes quick experimentation and rapid iteration, allowing startups to learn from their mistakes and pivot quickly. For a CFO, fostering a fast-fail mentality involves balancing risk-taking with financial prudence.

Encouraging Experimentation

Encouraging experimentation is a cornerstone of innovation. It involves creating an environment where team members feel empowered to test new ideas without the fear of failure. This can be particularly important in startups, where agility and innovation are crucial.

- Example: A startup is experimenting with various marketing strategies to determine the most effective approach. The CFO allocates a small budget for these experiments, tracking the ROI closely to identify the best-performing strategies.

- Application: Set aside a portion of the budget specifically for experimentation. Establish clear metrics for success and failure, and review these regularly to make informed decisions.

Learning from Failures

Learning from failures is essential for growth and improvement. Each failure provides valuable lessons that can guide future efforts. A culture that views failure as an opportunity rather than a setback can lead to greater innovation and resilience.

- Example: After a failed product launch, a CFO conducts a thorough post-mortem analysis to understand what went wrong. This analysis leads to valuable insights that inform future product development efforts.

- Application: Implement a structured process for reviewing failures. Encourage team members to share lessons learned and integrate these insights into future planning.

Iterative Improvement

Iterative improvement involves continuously refining products, services, and processes based on feedback and performance data. This approach ensures that the company remains agile and responsive to market needs.

- Example: A CFO oversees the iterative development of a new software product, ensuring that each version incorporates user feedback and performance data. This approach leads to a more refined and market-ready product.

- Application: Foster a culture of continuous improvement. Use feedback loops and performance metrics to guide iterative development processes.

II. The Strategic Role of a Chief Financial Officer

The role of a CFO in a startup extends far beyond traditional financial management. A strategic CFO acts as a partner to the CEO, guiding the company through financial uncertainties and strategic decision-making.

Financial Planning and Analysis

Financial planning and analysis (FP&A) are critical functions for a CFO. This involves creating detailed financial models that forecast various scenarios, helping the executive team make informed decisions about investments, hiring, and expansion.

- Example: A CFO develops detailed financial models to forecast various scenarios for the company’s growth. These models help the executive team make informed decisions about investments, hiring, and expansion.

- Application: Create robust financial models that incorporate different growth scenarios. Regularly update these models to reflect the latest market conditions and company performance.

Risk Management

Risk management is a vital aspect of the CFO’s role. This involves identifying, assessing, and mitigating financial risks to ensure the company’s stability and growth. Effective risk management strategies can protect the company from unexpected setbacks.

- Example: To mitigate financial risk, a CFO implements a hedging strategy to protect the company against currency fluctuations. This strategy provides financial stability and predictability.

- Application: Identify the key financial risks facing your startup. Develop and implement strategies to mitigate these risks, such as diversifying revenue streams or securing lines of credit.

Capital Allocation

Capital allocation is about deciding where to invest the company’s resources for maximum return. A strategic CFO evaluates various investment opportunities, prioritizing those that align with the company’s goals and offer the highest potential return on investment.

- Example: A CFO evaluates various investment opportunities, prioritizing those that align with the company’s strategic goals and offer the highest potential return on investment.

- Application: Establish criteria for evaluating investment opportunities. Ensure that capital allocation decisions are aligned with the company’s long-term strategic objectives.

Stakeholder Communication

Effective stakeholder communication is crucial for maintaining trust and securing support. This involves preparing clear and compelling financial reports and presentations for investors, board members, and other stakeholders.

- Example: During a funding round, a CFO prepares detailed financial reports and presentations to effectively communicate the company’s value proposition and financial health to potential investors.

- Application: Develop strong communication skills. Prepare clear, concise, and compelling financial reports for stakeholders, including investors, board members, and employees.

Building Financial Infrastructure

Building a robust financial infrastructure involves implementing systems and processes that streamline financial management and provide real-time insights. This ensures that the company’s finances are well-managed and scalable.

- Example: A CFO implements an integrated financial management system that streamlines accounting, budgeting, and reporting processes, providing real-time financial insights to the executive team.

- Application: Invest in financial management systems that provide accurate and timely data. Ensure that these systems are scalable and can support the company’s growth.

Fostering a Financially Savvy Culture

Fostering a financially savvy culture means ensuring that all employees understand the financial aspects of the business and how their roles contribute to the company’s financial health. This can lead to better decision-making at all levels.

- Example: A CFO conducts regular financial literacy workshops for employees, helping them understand the company’s financial goals and how their roles contribute to achieving these goals.

- Application: Promote financial literacy within the organization. Ensure that all employees understand the financial implications of their decisions and actions.

The role of a CFO in a startup is multifaceted and dynamic, requiring a blend of financial acumen, strategic insight, and leadership. By embracing a fast-fail mentality, a CFO can foster a culture of innovation and resilience. At the same time, the strategic responsibilities of a CFO—ranging from financial planning and risk management to capital allocation and stakeholder communication—are crucial for steering the company towards sustainable growth. For startups aiming to navigate the complexities of the business landscape, the lessons from a seasoned CFO provide a valuable roadmap to achieving financial stability and long-term success.

Join Benoy and Ike on the Fearless Founders podcast, where professionalism meets fun, and every episode is a step towards realizing your entrepreneurial dreams. Tune in on YouTube and Spotify, and visit their website for access to premium services that elevate your business journey. This is your opportunity to learn, grow, and thrive in the dynamic world of entrepreneurship.